Recent Commercial Posts

How Do You EstimateThe Cost Of Cleanup And Restoration After A Fire?

10/26/2022 (Permalink)

If your business has been affected by a fire, don’t hesitate to get in touch with your local SERVPRO.

If your business has been affected by a fire, don’t hesitate to get in touch with your local SERVPRO.

How Do You Calculate The Cost Of Fire Cleanup And Restoration?

Estimating the damage done by a fire in your home or business in Phoenix, AZ, is never easy. It's not just about getting rid of the smoke, soot, and water—it's about restoring your property to its pre-fire condition. So, how do you estimate the cost of fire damage?

What is a fire damage estimate?

A fire damage estimate is a written document that estimates the cost of repairing a home after a fire. When you receive your Fire Claim from your insurance company, they will send an adjuster to inspect the property. This person will take photographs and measurements so that he or she can prepare an accurate estimate for you. The adjuster may ask you questions about your belongings so that all your possessions are accounted for in their report (for example: “How many pairs of jeans do you have?”).

How does it work?

Once the adjuster has finished collecting all necessary evidence and information about what happened at your residence, he or she will begin calculating how much each item would cost if he or she had to replace it with new items. This process is called replacement value. If something was irreplaceable—like family heirlooms—and cannot be replaced by purchasing another exact replica, then its value will be determined based on what someone might pay for it at auction or other means.

The Steps of Fire Damage Cleanup and Restoration

Assessing the Fire and Smoke Damage

Fire damage is a complex and multi-faceted process. The first step to assessing the fire and smoke damage is to determine what’s salvageable, which can be done by looking at each item individually. Next, you should tarp and board up your property so that outside factors don’t damage your property. After that, the damage needs to be cleaned up before the restoration can begin.

Tarping and Boarding Up Your Property

If you have a residential property, it’s important to begin tarping and boarding up windows, doors, and other openings on your house. This can help prevent damage from rainwater and wind erosion. The most effective way to board up your windows is going to be with plywood.

Usually, a fire cleanup and restoration specialist will offer tarping and board-up services!

Fire Cleanup Services

After the fire, your property will be a mess. The fire department will have left it in shambles, soaked and charred. You need to hire a company that specializes in cleaning up after fires to restore your home back to its pre-fire condition as soon as possible.

Fire restoration specialists will remove all the debris and contaminants from your property, including ash and soot stains that may not be visible at first glance. They'll also clean and disinfect the premises so there's no chance of bacteria or mold spreading around through air or dust particles left behind after cleanup efforts are complete.

Once everything has been removed from inside your house (including furniture), they can begin repairing affected areas such your floors, walls, and ceilings. Some companies, like SERVPRO of Northwest Phoenix, also offer content restoration services as well.

The Fire Restoration Phase

The final step in the process is known as the fire restoration phase. This is when the property is cleaned and restored to its pre-fire condition. Depending on how much damage was caused by a fire, and how long it takes for your insurance company to process your claim, this can take several weeks. In some cases, you may need to stay at another home or hotel until repairs are completed.

If your home or business has been affected by a fire, don’t hesitate to get in touch with us. We can help you through every step of the process. Our team has years of experience in assessing and repairing damaged properties, and we always treat our customers with respect, compassion, and honesty.

How To Lower Business Interruption Insurance Loss

8/11/2022 (Permalink)

Business interruption insurance can help your business and your employees during a shutdown due to an emergency or disaster

Business interruption insurance can help your business and your employees during a shutdown due to an emergency or disaster

Know How To Lower Your Business Interruption Insurance Loss

In the event your business in Phoenix, AZ, suffers water damage from flooding due to a broken pipe or other unexpected disaster, your business may not be functional until things are repaired and restored. Business owners often plan ahead with insurance to physically repair their business in case of disaster, but don't plan for how to financially stay afloat while the business is closed down. Business interruption insurance can help with operating expenses while you are focused on recovery.

What Is Covered

Business interruption insurance can help your business and your employees during a shutdown due to an emergency or disaster. It provides for the following financial necessities during a temporary closure:

- Lost net income based on your financial records

- Mortgage, rent, and lease payments

- Loan payments

- Taxes

- Employee payroll

What Is Not Covered

Business insurance does not cover everything. The primary purpose is to keep the business financially above water during a temporary closure. Items and damages covered by other types of insurance policies will not be covered on a business interruption claim. In light of recent events, it is important to note that business interruption insurance does not apply to shutdowns due to pandemics, viruses, or communicable diseases. The following damages are not covered:

- Broken items resulting from a covered event or loss

- Damages caused by flooding or earthquakes, which are covered by a separate policy

- Undocumented income not listed in your business' financial records

- Utilities

Lower Your Loss

While business interruption insurance doesn't cover the actual physical damages caused by flooding, those damages are often covered by other insurance. Large water damage often requires extensive cleanup and repairs. The best way to lower your business interruption insurance loss is to get your business back up and running as soon as safely possible. A quick recovery aided by a restoration specialist will lower the claim on your business interruption insurance. They can often work with you and your insurance company to get started on recovery without much delay.

How to Estimate Fire Damage to a Business

7/23/2022 (Permalink)

Fire damage to a restaurant in Phoenix, AZ.

Fire damage to a restaurant in Phoenix, AZ.

How to Estimate Fire Damage to a Business

Fires are one of the most common disasters to strike businesses. Fortunately, most fires in Phoenix, AZ, are small and easily dealt with. However, every year in the U.S., there are over 100,000 fires, with fire damage losses to commercial properties exceeding $2.4 billion annually.

Generally, the damage estimate is done by either the insurance adjuster or a qualified Preferred Vendor. In most cases, it’s in your interest to choose a restoration expert to make a solid appraisal based on the damage and circumstances.

The Factors in the Assessment

By far the largest factor in your estimate is the amount of damage. Three areas of damage are examined:

If the commercial fire was tiny, put out immediately and the soot is contained in a small area, you may be able to clean it yourself. If you need a restoration specialist for very small jobs, the cost may not exceed your insurance deductible.

A Good Time To Have Fire Insurance

If the fire damage is widespread, you’ll need to make an insurance claim. If you don’t have insurance, your restoration expert may find you low-cost options to reduce the sting. In widespread fires like wildfires, there may be disaster grants available, too.

Insurance Adjusters and Restoration Specialists

Insurance companies and restoration experts work closely together to ensure high-quality standards, but each may have different goals. When you choose an experienced commercial fire damage restoration company to do the assessment, their goal will be to get you the highest-quality restoration.

In many cases, items can be restored instead of replaced. This can help keep a place looking more authentic, along with saving items that you’d prefer to keep. The fire mitigation company will have a much better idea about what their custom soot and smoke cleanup solvents will be able to save and what must be replaced.

The estimate process should be transparent, and you should ask any questions that arise as it’s explained to you. With reputable companies, you’ll get a rock-solid estimation and can quickly start to rebuild your business.

Storm Preparation Tips for Property Managers

7/7/2022 (Permalink)

If the damage is bad, call SERVPRO.

If the damage is bad, call SERVPRO.

How Do You Prepare For A Storm?

Management of commercial property in Phoenix, AZ comes with quite a few responsibilities. One of the most important of those tasks is storm preparedness, particularly if you live in an area that experiences frequent hurricanes or other storms. It is your duty as a manager to make sure your information, property, and people are all protected in an emergency situation.

Protecting Your Information

While it's a smart idea to back up all your files in a remote location on a regular basis anyway, doing so has extra benefits during storm season. There are several key pieces of information that you will need to be able to access when disaster strikes:

- List of emergency phone numbers

- Contact information for trusted storm restoration specialists

- Storm preparation plan of action

- Emergency contact list for all employees and residents, including information about children and pets

- Business continuity plan outline

- Essential financial information, such as bank routing numbers

Your storm preparedness plan should include access to all the files you need to continue operations. Don't let damage to your building get in the way of your business.

Protecting Your Property

One of the first calls you should make after your building suffers storm damage is to your insurance company. The more quickly you report a problem, the more quickly an adjuster can come out and survey the damage done. Key members of the property management team should accompany the adjuster to point out issues discovered during their own inspection so that nothing gets overlooked.

Protecting Your People

When you manage a residential property, your primary concern after a storm is the safety and security of your residents. They have been through an ordeal and are likely going to need your support. As the property manager, it is important for you to have a system in place to communicate consistently with all parties affected by the displacement. Having a plan in mind for evacuation and temporary housing can help improve a bad situation.

Having a storm preparedness plan is essential. It's not enough to protect your commercial property. You also must protect the people it serves.

What Is Pollution Liability Coverage and Does It Cover Mold?

3/4/2022 (Permalink)

SERVPRO has the equipment and expertise to handle mold damage of all sizes. When your business suffers any mold damage, give us a call!

SERVPRO has the equipment and expertise to handle mold damage of all sizes. When your business suffers any mold damage, give us a call!

What Is Pollution Liability Insurance, And Does It Include Mold?

As a contractor in Peoria, AZ, it's important to you to maintain your reputation as a professional. Of course, your reputation is built primarily on your skill and communication during a project, but one element that has a big impact is how you conduct yourself when something goes wrong.

When something goes wrong is when insurance companies get involved, and for contractors, it's important to have the right type of coverage that will protect your business as well as give you the means to do right by your client. Since many General Liability policies don't cover a mold claim that requires inspection or remediation by a mold remediation specialist, you need to make sure that you have the right kind of coverage. What is it and how does it work?

Pollution Liability Coverage

Pollution liability covers you in the event that your client claims that they sustained damages from pollutants caused by your work. In most GL policies, any mention of mold insurance claims triggers the mold exclusion policy. Adding pollution coverage can protect you in a few ways.

Covers Gaps in Your GL Policy

When you get a pollution policy that specifically covers mold, you are protecting yourself from at least some of the exclusions that are often found in general liability policies. This will also protect your while you work at a job site other than your office.

Customizable for Your Business

If you regularly work with any sort of contaminants, this extra policy can be written specifically with your job type in mind. You can include enhancements such as coverage while loading and unloading materials, while on the road, and during storage.

Works with Other Policies

You don't have to stop with general and pollution policies. Other types of environmental liability insurances and umbrella policies can all work together to protect you from mold insurance claims. Consider obtaining all your policies through one company to avoid any back and forth when submitting a mold claim.

Mold insurance claims can be daunting when you don't have the proper coverage. Review your policies on a regular basis to ensure that your business is well protected.

Why You Want To File Your Insurance Claim Electronically

3/4/2022 (Permalink)

Filing a claim is faster than ever, especially if you use a remediation company like SERVPRO

Filing a claim is faster than ever, especially if you use a remediation company like SERVPRO

Why Do You Want to File Your Insurance Claim Online?

When a fire, flood or another disaster strikes, you want to get things fixed and your business back on its feet as soon as possible. The best way to do this is by filing your insurance claim electronically. Many companies are now offering quick and easy solutions to the traditional mail-in claims service.

It Is Fast

Filing a claim is faster than ever, especially if you use a remediation company like SERVPRO in Anthem, AZ. Companies like this can:

- Assess the damage

- Take photographs

- Document damages

- Solve the immediate problem preventing

- further damage

- File the claim

They often work directly with the insurance companies, and all of the paperwork gets there in the time it takes to send an email.

Increase Claim Accuracy

Your claim is subject to lost mail and delays due to missing information. When you file electronically, the forms themselves will tell you if something is wrong or missing, or an insurance agent can tell you if they need more information. You can view all of the files associated with your claim and add information as needed.

Online Status Tracking

Using electronic filing allows you to track your insurance claim on the internet. Companies can also send you email or text updates if you choose. You don't have to sit around wondering what is happening with your claim anymore. When the claim gets to the company, you will know when it is accepted and when it is being processed.

Less Paperwork

Insurance filing takes a lot of paper and printing when they are not filed electronically. You fill out the forms, and the insurance company digitizes them. Then prints them and sends them to you. Then you fill out more paperwork if something is inaccurate. This is a huge cycle of paper. With an electronic submission, all you have to do is use your computer and check your email.

An electronic filing is one of the fastest and easiest ways that you can file an insurance claim. It can help get you back on your feet and back to business in no time.

Commercial Storm Mitigation and Restoration Tips

1/31/2022 (Permalink)

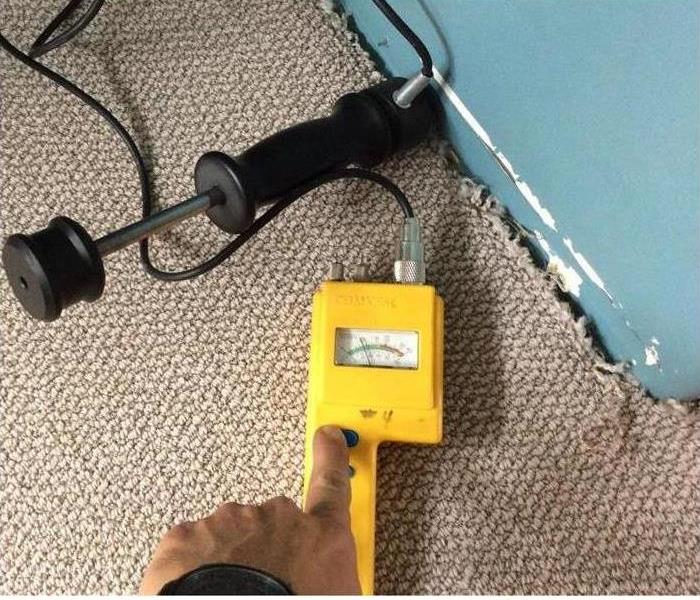

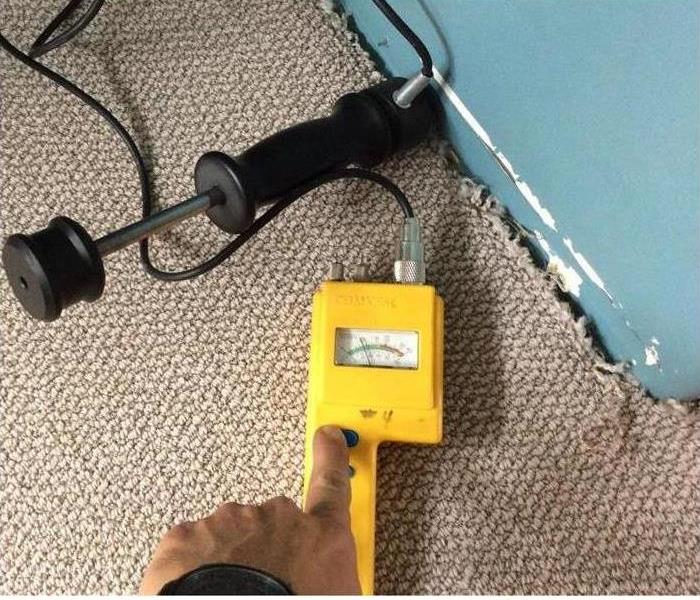

Our SERVPRO team of IICRC-certified managers and technicians are here to help business owners when they have any water damage.

Our SERVPRO team of IICRC-certified managers and technicians are here to help business owners when they have any water damage.

Storm Mitigation And Restoration Tips For Businesses

It only takes a brief time for a storm in Anthem, AZ, to cause significant damage to your business. The recovery process, however, takes much longer. There are two phases after the storm. First, the flood cleanup company mitigates the damage. Second, the restoration company returns your business to preloss condition. Here are some tips for both stages of recuperation.

Storm Mitigation

Mitigation refers to the process of stopping further loss from occurring. When a storm hits, water damage is the most likely culprit. Wind, hail and even lightning strikes cause problems as well. These are some key points for understanding the first part of recovery:

- It is important to act fast. Water spreads quickly and causes secondary damage within 24-48 hours, such as mold growth. Contact the flood cleanup company as soon as possible after you suspect storm damage.

- The mitigation process may be relatively quick. First excess water is extracted, and unsalvageable materials are disposed of. Then the area is thoroughly dried, cleaned and sanitized.

Storm Restoration

After the damage is controlled, the second round focuses on returning your property to its pre-storm state. Although ideally one company covers both steps, restoration differs from mitigation in these ways:

- While still important to complete in a timely manner, the immediacy of intervention is not as critical. However, every day your business is not open you lose revenue.

- Depending on the level of destruction, this portion likely takes longer. Damaged drywall may need replaced, floors repaired, carpet installed or painting completed. In addition to the structure, contents and inventory are repaired or replaced as well.

A storm in Anthem, AZ, wreaks havoc on your business. Recovery from water and other damage occurs in two phases: mitigation and restoration. For mitigation, it is crucial to use a flood cleanup company that is Faster to Any Size Disaster because every second counts. The restoration company then returns your property to preloss condition.

If your business has been affected by a fire, don’t hesitate to get in touch with your local SERVPRO.

If your business has been affected by a fire, don’t hesitate to get in touch with your local SERVPRO.

24/7 Emergency Service

24/7 Emergency Service